Free Tax Preparation for Seniors in Oneida Canastota & Surrounding Areas

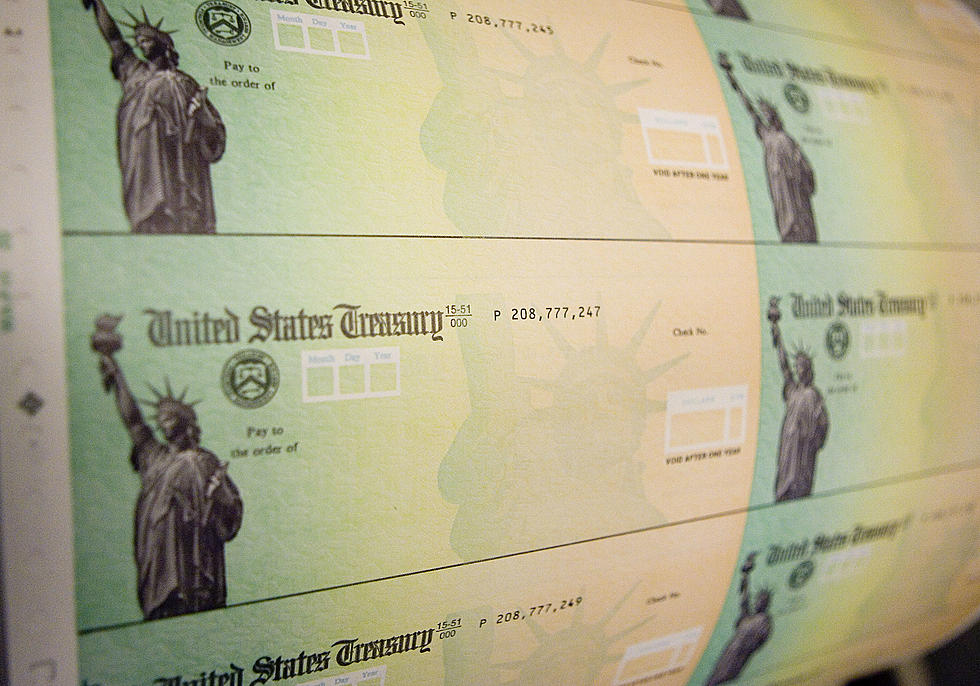

Trying to understand the tax filing laws and legislation is never easy. The rules seem to change every year, then toss in working from home, stimulus checks, and unemployment benefits and you're more likely to solve a Rubik Cube. The good news? There's free tax filing help for seniors.

Working through the Madison County office of Cornell Cooperative Extension the Income Tax Preparation program will be offered for Seniors age 60 or older. Certified volunteers will be preparing returns until April 15. One new wrinkle this year surrounds the $600 stimulus check. If you didn't receive it, an income tax return needs to be filed even if your income level doesn't require you to file.

COVID-19 guidelines require an appointment to be made as no walk-in sites are available. Call Judy Parker at 315-750-2638, leave your name, phone number, and what location you would like to visit. The CCE Madison County offices at 100 Eaton Street in Morrisville will make appointments every day of the week. Here are the other sites available and the days returns will be prepared:

· Caz Cares in Cazenovia on Fridays

· Oneida Public Library on Monday, Wednesday and Thursday

· Canastota Public Library on Wednesday.

· Sullivan Library-Chittenango on Monday & Wednesday

COVID-19 protocols will be in place at all sites. Visitors will be required to properly wear a mask, practice social distancing, and complete contact tracing paperwork. Only the client is allowed to attend the appointment, friends and family members will be required to wait outside.

Review last year's return to get an idea of what paperwork you'll need to bring to the meeting. In addition to bringing the return, have social security cards for everyone claimed, a picture ID and of course tax forms like W-2s and 1099s.

KEEP READING: Here are the best places to retire in America

LOOK: See the iconic cars that debuted the year you were born

More From 96.1 The Eagle

![These Peeps Rice Krispies Treats Are a Kaleidoscope of Color [GALLERY]](http://townsquare.media/site/498/files/2021/03/Peeps-Cover-Photo.jpg?w=980&q=75)